Pork Part 2: How Earmarks Shortchange New York

Part one of my earmarks series was a basic introduction to earmarks. In part two of my series on earmarks, I want to show how earmarks shortchange New Yorkers, and how earmarks directed to small, red states come out of our pockets.

Last

year, I wrote a

piece that pointed out the general inequity in redistribution of

tax dollars. In 2004, New York was 43rd in the ranking of states

receiving money back from the federal government. For every dollar of

taxes paid in to the Federal Government, New York got 79 cents back.

My piece also presented a couple of examples of deluxe airports in

North Dakota financed in large part by homeland security money. In

2004, North Dakota received $1.73 for every dollar sent to Washington,

more than twice New York's share.

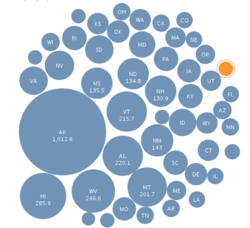

The "dollars back" picture is

The "dollars back" picture is

for overall federal funding. The picture for earmarks is even more

grim. The chart at right is from the

Many Eyes project. The size of the dots indicate the per-capita

amount of earmark money received by each state in 2005. The big fat

dot is Alaska, which received a stunning $1,012 per person in

earmarks. North Dakota's no Alaska, but its two senators and one

representative managed to wrangle $135 per person. You might need to

get out a magnifying glass to see New York's paltry $29 per person --

we're the little orange dot at the right.

It's no coincidence

that some of the biggest abuses of both earmarks and grants have come

from the smallest states. The

nowhere" in Alaska is the most popular example. The few million

dollars in earmarks obtained by Randy Kuhl are dwarfed by this $223

million bridge. It's also no coincidence the two most senior members

of the Alaska delegation are under

investigation, and one may

have been recorded accepting bribes..

The immense direct

power of earmarking leads to huge temptation to use that power for

personal gain. Even if there's no corruption involved, the

redistribution of tax dollars favors small, rural states. Because of

earmarks, New Yorkers are paying extra taxes to fund silly stuff like

go-nowhere bridges and palatial, untraveled airports.

Neither

candidate in this race has yet raised the fairness issue, but I think

it's worth a look, especially because it cuts across party lines.

Small-government conservatives should be disturbed by the amount of

federal intrusion required to redistribute our funds to rural states.

Anti-corporatist and pro-grassroots progressives should be bothered by

the degree of corporate control exercised via DC lobbyists.

Even though conservatives and progressives should be united on this

issue, it's a tough sell in the current environment. Local and

state governments have come to rely on a steady stream of grants and

earmarks to finance local projects. Congressmen and Senators have

made their ability to deliver pork a cornerstone of their campaigns

and fundraising efforts. Neither local nor national legislators

want to risk a change in a system that they've spent their careers

learning to manipulate.

Comments

Hi Rottenchester,

Thanks for using the earmarks visualization tool the Sunlight Foundation (my employer) created using Many Eyes. Glad you're finding it useful.

Since you already monitor earmark spending, I thought you might want to check out our new online investigative tool, EarmarkWatch.org . EarmarkWatch.org lets you determine if earmarks address pressing needs, favor political contributors or are simply pure pork.